Loan Apps without BVN: Loans are an essential part of many Nigerians’ financial planning, whether for personal use, business expansion, or emergencies.

But what if you want to get a loan without BVN? Can you borrow money without BVN in Nigeria?

With an increasing demand for privacy and convenience, the market for loan apps without BVN in Nigeria is growing.

This comprehensive guide will take you through everything you need to know.

From the loan apps that give loans without a BVN number, to their various application process, and even how to choose the best one for you, we’ve got you covered!

So, without any waste of time, let’s dive right in and explore!

Why Choose Loan Apps without BVN?

The BVN (Bank Verification Number) is a biometric identification system implemented by the Central Bank of Nigeria.

But not everyone feels comfortable providing it. Opting for a loan app in Nigeria without BVN means less paperwork and more privacy.

There are legitimate online loans without BVN in Nigeria. But it’s crucial to choose wisely and recognize the pros and cons of not using BVN for loan applications.

Check Out: Best Loan Apps without ATM Card in Nigeria

Top 7 Loan Apps Without BVN in Nigeria 2023

Looking for a loan app without BVN in Nigeria? Here’s a breakdown of some reputable platforms where you can get a loan without BVN:

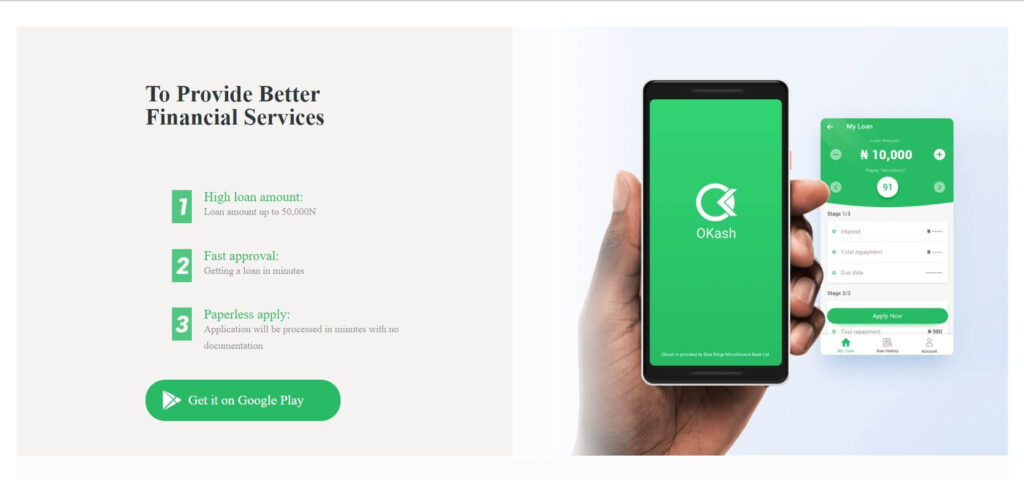

1. OKash

OKash is revolutionizing the way people get a loan without BVN in Nigeria. With a simple interface, this Nigeria loan app without BVN offers amounts ranging from ₦1,500 to ₦1,000,000 at attractive interest rates.

If you want to borrow money without BVN in Nigeria quickly, OKash can be your go-to option.

2. Fairmoney

Are you looking for an online loan without BVN that comes with flexible repayment plans? Fairmoney is just what you need.

It’s a reliable loan app that doesn’t require BVN and offers both personal and business loans.

The application process is easy, and you’ll appreciate the transparency in their terms.

3. JumiaOne

JumiaOne is not just a shopping platform; it’s also a fantastic place to get a loan without BVN number.

This unique loan app in Nigeria without BVN allows users to borrow for various needs without the usual bureaucratic hassles.

For those who often ask, “Which app can borrow me money without BVN?” JumiaOne is worth considering.

4. Aella Credit

Aella Credit is a trusted platform for loans without BVN needed in Nigeria. They have a reputation for quick approvals and offer a broad range of loan amounts.

If you’re looking for a loan app without BVN that provides financial education, Aella Credit also has resources to guide you.

5. PalmPay

PalmPay is another reputable loan app that does not require BVN. With its user-friendly interface, you can access an online loan without BVN in minutes.

Whether it’s an emergency or a planned expense, PalmPay is there to support you with loan apps BVN free.

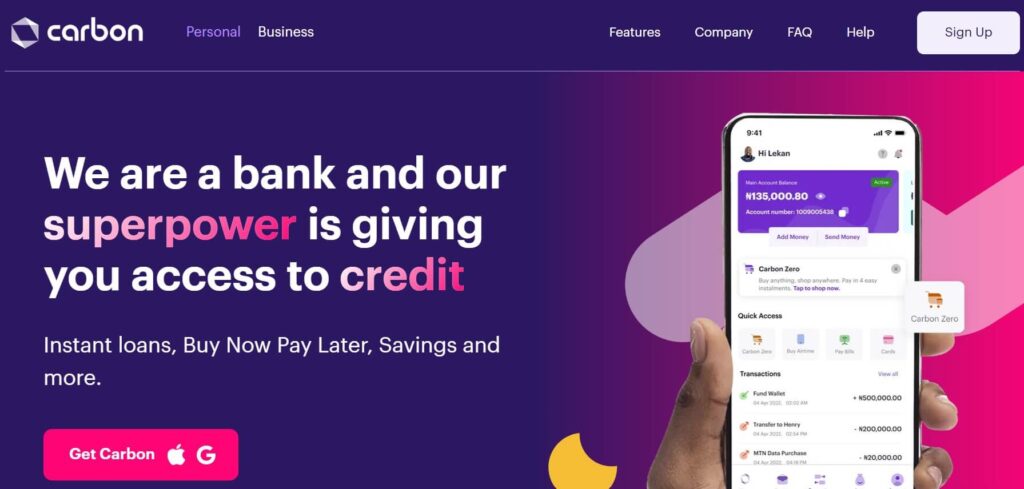

6. Carbon

Carbon offers a blend of convenience and flexibility, making it an ideal choice for those looking for a loan app in Nigeria without BVN.

From its straightforward application process to its seamless repayment methods, Carbon ensures that you can get a loan without BVN in Nigeria with minimal fuss.

7. CarrotPay

Last but not least, CarrotPay is a vibrant platform for those in need of loan apps without BVN. They provide various loan products without the need for a BVN number.

Their customer support is responsive, and many users praise CarrotPay as the answer to the question, “Which app can borrow me money without BVN?”

See Also: Loan Apps without Selfie in Nigeria

How to Apply for Loans Without BVN in Nigeria: A Comprehensive Guide

Applying for a loan without BVN in Nigeria is not only possible but also accessible through various platforms.

Whether you want to borrow money without BVN in Nigeria for personal needs or business expansion, the following guide will assist you in navigating the process:

1. Choose the Right Loan App Without BVN

Before you start, you need to identify the loan app in Nigeria without BVN that best suits your needs.

As we’ve already discussed, platforms like OKash, Fairmoney, and JumiaOne are some of the trusted places to get an online loan without BVN.

2. Download and Register

Once you’ve selected the loan app that doesn’t require BVN, download it from the App Store or Google Play.

Registration typically involves providing personal details, but don’t worry, your BVN number is not needed.

3. Determine the Loan Amount and Tenure

Different apps offer varying amounts and tenures for loans without BVN needed in Nigeria.

Choose an amount that meets your needs and a repayment schedule that aligns with your financial situation.

4. Provide Necessary Documents (Except BVN)

Some loan apps without BVN may request documents like your ID, proof of residence, or bank statement. Ensure you have these at hand to make the process smooth.

5. Review Terms and Conditions

Always read the terms and conditions of the loan app that does not require BVN carefully.

Understand the interest rates, which might range from 2% to 30%, and other related fees.

6. Confirm and Submit Your Application

Once you’ve reviewed all the details, confirm your application for the loan without BVN in Nigeria. Many apps offer quick approval, so you’ll soon get a response.

7. Receive Your Loan

Upon approval, you’ll receive your loan without BVN number directly into your bank account or mobile wallet. Some platforms might even provide instant disbursement.

8. Repay as per the Schedule

Follow the agreed repayment plan, often through Wallet Fund & Bank Transfer.

Timely repayment can improve your credibility on the platform, making it easier to borrow money without BVN in Nigeria in the future.

Understanding Interest Rates and Repayment Methods on No BVN Loans

When using a loan app in Nigeria without BVN, it’s vital to understand the interest rates, ranging from 2% to 30%, and the available repayment methods like Wallet Fund & Bank Transfer.

FAQs – Loan Without BVN in Nigeria

Which app can borrow me money without BVN?

Several apps can provide loans without BVN needed in Nigeria. The key is choosing a legitimate one.

Is it legal to get an online loan without BVN?

Yes, it’s legal to use a loan app without BVN, provided you meet other criteria.

How can I borrow without my BVN number?

You can borrow without BVN by using loan apps in Nigeria like OKash, Fairmoney, and JumiaOne that don’t require BVN.

How to borrow money without BVN in Nigeria?

Select a loan app without BVN in Nigeria, register, choose the amount, provide necessary documents (excluding BVN), and apply.

Do loan apps ask for BVN?

Some loan apps ask for BVN, but many platforms offer loans without BVN in Nigeria.

Can I get a loan without BVN in Nigeria?

Yes, you can get a loan without BVN through specific loan apps in Nigeria that don’t require it.

How to get a loan without BVN verification in Nigeria?

Choose a loan app that doesn’t require BVN, register, select an amount, and follow the application process.

Which app gives loan without BVN?

Apps like OKash, Fairmoney, and JumiaOne provide loans in Nigeria without requiring BVN.

Conclusion

Getting a loan without BVN in Nigeria is possible, accessible, and entirely legitimate.

With this guide, you can now confidently explore loan apps that don’t require BVN or choose a loan app that does not require BVN to meet your financial needs.

Feel free to comment and share your experiences with loans without BVN in Nigeria.